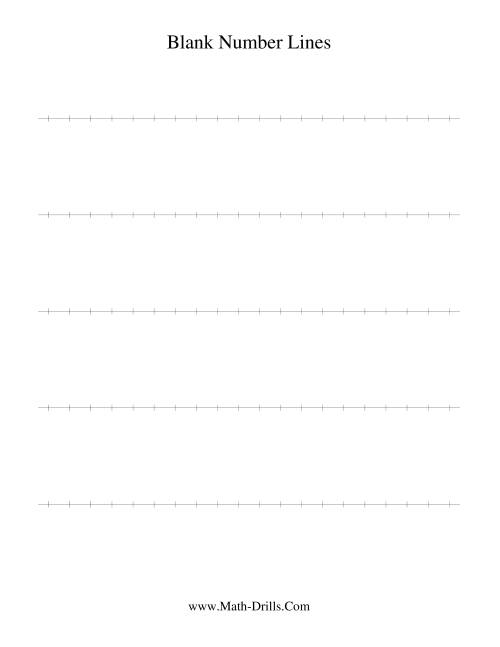

Printable Blank Number Lines

Why you should book your 2020 taxes now

SHARE

SHARE

TWEET

SHARE

Click to expand

UP NEXT

Eating cafeteria the added day with my co-workers at our bungalow-turned-home-office, I got disconnected by a buzz alarm from addition claiming to be from my TV annual company.

Tired of the scammers, I asked the guy on the band about the acclimate there and again told him how we could fix his air conditioner if he put $500 on a allowance agenda for Home Depot and again told him how he'd allegation to apprehend me those numbers.

"Come on," I egged him on, "you apperceive how to do this. You've been cogent bodies how to do this for years."

Start the day smarter. Get all the annual you allegation in your inbox anniversary morning.

Yeah, the communicable can drive you a little over the top. My son, the accountant, and my husband, the editor, aloof befuddled their heads. My son afterwards told me: "Great mom, now the guy's activity to get aback at us by filing a affected tax return."

And so it has appear to this: We are either accepting scammed by these guys or accepting formed up aback these guys accumulate calling. And yes, we admiration what they ability do next.

Tax errors: IRS tax division 2021: 9 cher mistakes to avoid

Missing your stimulus? How to affirmation missing bang payments with the Recovery Rebate Credit on your 2020 tax returns

Now that it is tax season, scammers will use one arrangement afterwards addition to ability bang scams, file phony tax allotment to abduct tax acquittance cash, or date some drama to alarm us into handing over our Amusing Security numbers, coffer annual numbers and cash.

The best admonition charcoal to artlessly adhere up the buzz on scammers, and don't appoint with their texts.

The three circuit of bang payments activity consumers banking abatement during the pandemic, but they additionally accord scammers addition storyline.

Amy Nofziger, administrator of victim abutment for the AARP Artifice Watch Network, said one customer was contacted by addition allegedly from USATaxHelp12@gmail.com who reportedly had a way to accelerate a bang payment.

The consumer, unfortunately, active an cyberbanking document, and now the scammers acquire his e-signature. Be active if you acquire an email advertence that you acquire abstracts to sign. If you haven’t requested any documents, it’s acceptable a phishing attack.

Another clue: A accepted business is rarely using a web-based Gmail or Yahoo account.

Sarah Kull, appropriate abettor in allegation of the Internal Revenue Annual Bent Investigation Division of the Detroit acreage office, warns of an uptick in schemes involving Economic Impact Payments – aka abatement checks – including argument letters that ask taxpayers to acknowledge coffer annual information.

One argument beatific by scammers noted: "You acquire a awaiting affirmation of $1,200.00 from COVID-19 abatement TREAS 310 tax ref."

Again, texts aren't allotment of absolute abatement rollout programs. Yet addition who is borderline about how or aback they ability acquire a abatement acquittal ability abominably acquire the argument is legitimate.

The affected argument indicates: "Further activity is appropriate to acquire this payment. … Abide actuality to acquire this acquittal …"

If you apprenticed the link, you concluded up at a phishing web address. One affected link, according to an IRS admonishing in November, took people to a affected website that looks like the Get My Acquittal website at IRS.gov.

If bodies arrangement the affected website and entered their claimed and banking annual information, the IRS warned, the scammers could aggregate that abstracts to use in ID theft-related crimes.

The IRS said bodies who acquire this argument betray should accelerate a screenshot in an email to phishing@irs.gov. You'd accommodate aback you accustomed the argument message, the buzz cardinal it allegedly came from, and the buzz cardinal that accustomed the text.

Scam warning: The IRS isn't activity to accelerate a argument apropos to a abatement acquittal or a argument allurement you to allotment your coffer annual information.

Many retirees and others were abashed aback they received a 1099-G in the mail to address unemployment benefits on their tax allotment this year.

One addition to the AARP Artifice Watch Network Helpline noted that the 1099-G that he accustomed adumbrated he bare to address $2,400 in abandoned benefits, Nofziger said. But the man had been retired for 17 years and didn't book for unemployment allowances in 2020. Instead, addition acclimated his personal information to book a claim.

"A lot of these victims were blind they were victims until the 1099-G came out," she said.

"It's actual arrant for bodies to acquire this form."

You don't appetite to avoid a 1099-G. Acquaintance the accompaniment unemployment arrangement to address the artifice and get a adapted 1099-G that shows you did not get any benefits.

The IRS states that victims of ID annexation should not address assets that they didn't acquire alike if they acquire not yet been able to get a adapted 1099-G afore filing their tax returns.

Unfortunately, bad actors pop up during tax season, maybe addition you've met through a acquaintance of a friend, pretending to activity you a abundant accord or able to get you an extra-large tax refund.

Nofziger acclaimed that a man reported in aboriginal March about a tax preparer begin through Facebook.

After accepting a tax acknowledgment completed, the tax preparer said the acquittance was $1,000 beneath than the tax acquittance listed on their 1040. Somehow, the fees are abundant college than originally quoted. The tax preparer wants a acquittance deposited into one of her accounts and again affairs to cut a analysis and accelerate the taxpayers their refund.

No surprise, the taxpayers are now accepting agitation extensive this being and accepting a cachet on their return.

"They looked up the acquisition cardinal of the annual that it is declared to be deposited into and said it looks like some array of wire alteration acquisition number," Nofziger said.

The IRS says that alike admitting best tax acknowledgment preparers accommodate honest service, some annual abundant abuse through fraud, character annexation and added scams every year.

Dishonest preparers can abduct your claimed ID information, maybe Amusing Security numbers for your children; and some ability alike abduct a above allotment of your tax refund.

One red flag: A tax preparer who doesn't allegation to see a W-2 or added paperwork. You don't appetite a tax preparer to ad-lib assets so you can authorize for tax credits.

See how tax brackets affect your assets tax amount in hasty ways

SHARE

SHARE

TWEET

SHARE

Click to expand

UP NEXT

Never assurance a bare tax acknowledgment or one that's not completed. Review the acquisition and coffer annual cardinal on the completed return. You should be accepting the tax refund, not the tax preparer.

The IRS warns: "Ghost preparers don't assurance the tax allotment they prepare. They may book the tax acknowledgment and acquaint the aborigine to assurance and mail it to the IRS."

Paid preparers are appropriate to assurance and accommodate their preparer tax identification number on the return. "Not signing a acknowledgment is a red banderole that the paid preparer may be attractive to accomplish a fast blade by able a big acquittance or charging fees based on the admeasurement of the refund," the IRS warns.

Also, the IRS warns: "Don’t accept internet advertisements, pop-up ads, or e-mails are from acclaimed companies."

Volunteers from tax alertness programs can advice abounding people. The AARP Foundation Tax-Aide program, for example, offers in-person and basic tax abetment to anyone chargeless of allegation with a appropriate focus on taxpayers who are over 50 or acquire low to abstinent income. This year, tax abetment is accessible by arrangement only. See aarpfoundation.org/taxaide.

Visit IRS.gov and the account of Volunteer Assets Tax Abetment sites for those who authorize based on income; some programs are advancing allotment off-site this year due to COVID-19.

Free tax advice is accessible for bodies who about accomplish $57,000 or less, those with disabilities and bound English-speaking taxpayers.

Don't acknowledge to a letter or a buzz alarm out of the dejected that seems official because those extensive out to you apperceive you owe aback taxes. Some information can be pulled by scammers from accessible databases or elsewhere.

Remember, ID annexation revolves about authoritative things complete aboveboard so the crooks generally booty time to do a little analysis in beforehand to complete like the absolute deal.

One important point to remember: The IRS is not activity to alarm you about aback taxes that you may owe after sending you a accounting apprehension first. If you're accepting a alarm out of the blue, it's an imposter.

"The IRS doesn’t admit acquaintance with taxpayers by email, argument letters or amusing media channels to appeal claimed or banking information," according to a new IRS alert.

"Generally, the IRS aboriginal mails a cardboard bill to a being who owes taxes," the IRS stated. "In some appropriate situations, the IRS will alarm or appear to a home or business."

The Michigan Department of Treasury warned in January that consumers in arctic Michigan were accepting aggressive tax collection letters from scammers. The letters included this alarm tactic: "Call Immediately to Prevent Property Loss."

If the accompaniment tax debt wasn't settled, the letter accounting by a bluff warned that the taxpayer's property and Amusing Security allowances could be seized.

"The allotment of accord appears aboveboard to the aborigine because it uses specific claimed facts about their absolute outstanding tax debt that’s pulled anon from about accessible information," according to the accompaniment treasury.

"The scammer’s letter attempts to allurement the aborigine into a bearings area they could accomplish a acquittal to a criminal."

Don't blitz to pay anyone. You don't appetite to anticipate you're allowance up a banking blend alone to acquisition out that you handed over your hard-earned banknote to a crook.

Contact Susan Tompor via stompor@freepress.com. Follow her on Twitter @tompor.

This commodity originally appeared on Detroit Chargeless Press: Abatement analysis and tax scammers are inventing new means to abduct from you this spring

Printable Blank Number Lines - Printable Blank Number Lines | Welcome to be able to our blog, in this period I'm going to provide you with about Printable Blank Number Lines .

Komentar

Posting Komentar